What To Expect From Best Learner Driver Insurance?

I settled her uninsured motorist bodily harm declare with Nationwide for $130,000 without a car accident lawsuit. Once i make a claim towards my client’s uninsured motorist insurance coverage protection, I send a special letter. You only need to supply some primary information (address, car make and mannequin, owned or leased) and say how much you may spend and Progressive will show you policy choices inside your funds. If you’re looking to lower your rates, you don’t legally want to buy full coverage until you’ve got a mortgage or lease on your new trip. Collision insurance is optional except it’s required in your automotive mortgage or lease. Should You purchase Or Lease? It is a good rule of thumb to purchase greater than the essential minimums but that doesn’t mean you’ll want to buy the maximum amount available. Affordable car insurance does not imply it’s important to compromise on service and extra features.

I settled her uninsured motorist bodily harm declare with Nationwide for $130,000 without a car accident lawsuit. Once i make a claim towards my client’s uninsured motorist insurance coverage protection, I send a special letter. You only need to supply some primary information (address, car make and mannequin, owned or leased) and say how much you may spend and Progressive will show you policy choices inside your funds. If you’re looking to lower your rates, you don’t legally want to buy full coverage until you’ve got a mortgage or lease on your new trip. Collision insurance is optional except it’s required in your automotive mortgage or lease. Should You purchase Or Lease? It is a good rule of thumb to purchase greater than the essential minimums but that doesn’t mean you’ll want to buy the maximum amount available. Affordable car insurance does not imply it’s important to compromise on service and extra features.

This article has been created by GSA Content Generator DEMO!

This article has been created by GSA Content Generator DEMO!

How are you able to lower your premium through the use of a car insurance coverage calculator if you’re a first Time driver? Auto insurance firms set premium charges based mostly largely on statistical data that shows how often claims have been paid over a three yr interval for every automobile make/model. Our information reveals that the common value of car insurance coverage for young drivers aged 21-24 is 103624 per yr. Average car insurance for a new driver price for a 17-yr-previous male is on average 196 % higher than a more skilled 25-year-old male driver, and rates for a 17-12 months-old female are about 103 p.c higher than for 25-12 months-previous feminine drivers. Companies like Turo and Getaround make it straightforward to rent your automotive to native drivers for a few days each month. Make sure to gather insurance coverage quotes online and contact just a few native independent insurance coverage brokers to shop your charges. As a brand new driver, it’s in your finest curiosity to buy around extensively. An accident the place you are blamed makes pricier premiums more likely, but not in every state of affairs with every company, Gusner says, which is why it’s prudent to shop for the most effective charges by doing a automobile insurance comparability. This post was generated with the help of GSA Content Generator Demoversion!

It’s slightly extra difficult than just looking at charges, which we did above. Depending upon your circumstances, you may have extra than simply the fundamentals. As well, it will be significant that get the right type of protection and the correct quantity of coverage so that you are completely protected in the event of a automobile instant where you will need to make a claim. The time period “no fault” refers to the fact that you don’t must prove who was at fault as a way to receive compensation from your insurance company. Insurers equip your automotive with a black field, which then sends details of your driving again to the insurance company. As we’ll focus on later, there are a selection of things that may affect your rates, and the way much those elements affect your charges varies from firm to company. What other components affect your automotive insurance rates? Whether or not your private harm declare is going to affect your rates depends upon who is liable for the accident. This article was generated with the help of GSA Content Generator Demoversion!

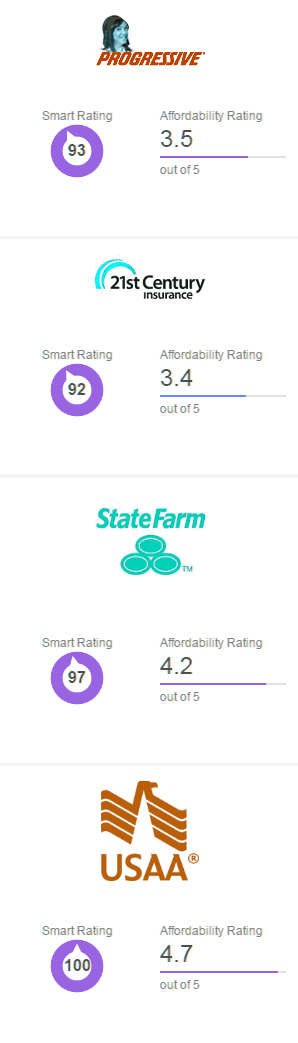

As for protection options, GEICO gives medical funds, private harm safety, uninsured/underinsured motorist, collision and complete protection. Averages are based on insurance coverage for a single 40-12 months-outdated male driving a 2017 Honda Accord, with policy limits of 100/300/100 ($100,000 for injury liability for one individual, $300,000 for all injuries and $100,000 for property injury in an accident) and a $500 deductible on collision and comprehensive protection. Farmers normal protection options embrace liability, property damage, collision, complete protection, uninsured/underinsured motorist, medical funds and personal damage protection. You’ll have to request a quote via your insurer to see how much the surcharge will actually be primarily based on your personal score factors. It does this via its well-identified Name Your Price tool, which neatly reverses the usual technique of getting an insurance quote. You can start getting quotes right right here. Alternatively, falling behind on payments can hurt your credit rating.